Can Foreigners Own Condos in Thailand?

Yes, foreigners can legally own a condo unit in Thailand under the Condominium Act (Section 19) if they meet at least one of the following conditions:

– You have legal residence in Thailand

– You’re allowed to stay under Thailand’s investment promotion laws

– You own a company registered under Thai law

– Your company has received investment promotion from the Thai government

– You bring foreign currency into Thailand to buy the condo

Important Rule: Foreign ownership is limited to 49% of the total floor area of all condo units in a building. The rest must be Thai-owned.

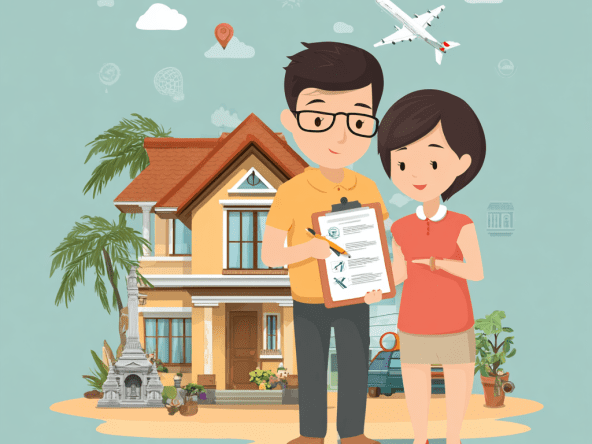

Steps to Buy a Condo in Thailand

Step 1: Start Your Property Search

– Choose the city or area (e.g. Bangkok, Pattaya, Hua Hin)

– Decide your budget and purpose (living, retirement, or investment)

– Work only with licensed real estate agents and reputable law firms

Tips:

– Read real estate FAQs and learn about common scams

– Check the developer’s reputation if buying off-plan (before construction is completed)

Step 2: Get Legal Help

Before signing anything, hire a Thai property lawyer. They will:

– Do a title search to confirm who owns the land

– Review or draft the Sale and Purchase Agreement

– Help negotiate price, fees, and transfer terms

If buying off-plan:

– Know that prices vary by floor, direction, and layout

– Understand there are often no refunds if the project is delayed or changed

Step 3: Transfer Money from Abroad

To legally register ownership:

– You must transfer the full condo price in foreign currency from abroad

– The purpose of the transfer must be stated as buying a condo

– The receiving Thai bank must issue a Foreign Exchange Transaction Form (FETF) as proof

Can Foreigners Get Mortgages in Thailand?

Yes, but it’s limited. Two banks may offer mortgages to foreigners:

– Bangkok Bank (Singapore branch)

– UOB (United Overseas Bank)

Loans are in foreign currencies (USD, EUR, or JPY). Interest rates depend on the currency and loan terms.

Final Step: Transfer of Ownership

Once the property is ready and you’ve paid the full amount:

– Ownership transfer is done at the local Land Office

– You can go in person or give Power of Attorney to your lawyer

Fees You Will Pay at the Land Office

| Fee Type | Rate | Who Pays? |

| Transfer Fee | 2% of value | Usually buyer |

| Stamp Duty | 0.5% | Seller or buyer |

| Specific Business Tax | 3.3% | Seller (if sold within 5 yrs) |

| Withholding/Income Tax | Varies | Seller |

Final Thoughts

Buying a condo in Thailand is one of the few legal ways foreigners can own property. It’s important to:

– Follow all legal steps

– Use a trusted lawyer

– Transfer money correctly

– Understand the rules about ownership limits

Taking the right steps from the beginning will help avoid costly mistakes and give you peace of mind in your Thai property investment.